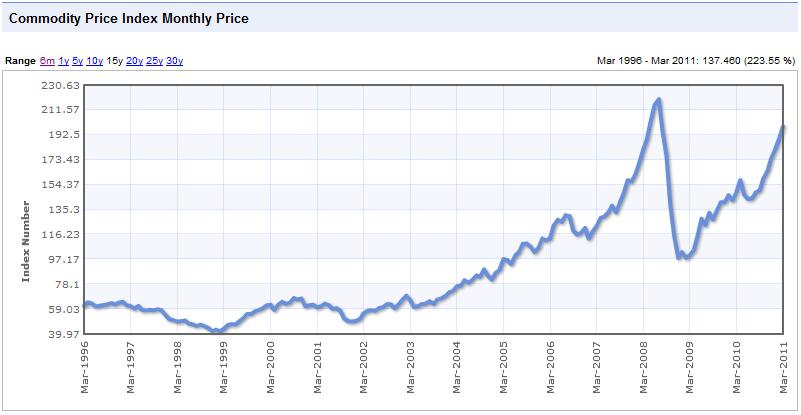

Propelled by economic recovery and the recent Mideast political turmoil, oil prices have firmly shaken off any lingering credit crisis weakness, and are headed towards a record high. Moreover, analysts are warning that due to certain fundamental changes to the global economy, prices will almost certainly remain high for the foreseeable future. The same goes for commodities. Whether directly or indirectly, the implications for forex market will be significant.

First of all, there is a direct impact on trade, and hence on the demand for particular currencies. Norway, Russia, Saudia Arabia, and a dozen other countries are witnessing record capital inflow expanding current account surpluses. If not for the fact that many of these countries peg their currencies to the Dollar and/or seem to suffer from myriad other issues, there currencies would almost surely appreciate. In fact, the Russian Rouble and Norwegian Krona have both begun to rise in recent months. On the other hand, Canada and Australia (and to a lesser extent, New Zealand) are experiencing rising trade deficits, which shows that their is not an automatic relationship between rising commodity prices and commodity currency strength.

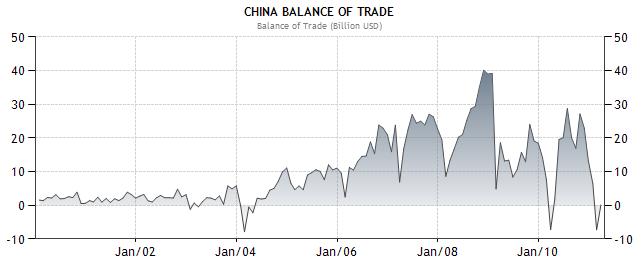

Those countries that are net energy importers could experience some weakness in their currencies, as trade balances move against them. In fact, China just recorded its first quarterly trade deficit in seven years. Instead of viewing this in terms of a shift in economic structure, economists need to understand that this is due in no small part to rising raw materials prices. Either way, the People’s Bank of China (PBOC) will probably tighten control over the appreciation of the Chinese Yuan. Meanwhile, the nuclear crisis in Japan is almost certainly going to decrease interest in nuclear power, especially in the short-term. This will cause oil and natural gas prices to rise even further, and magnify the impact on global trade imbalances.

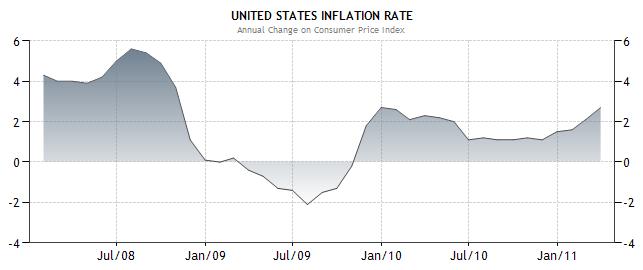

A bigger issue is whether rising commodities prices will spur inflation. With the notable exception of the Fed, all of the world’s Central Banks have now voiced concerns over energy prices. The European Central Bank (ECB), has gone so far as to preemptively raise its benchmark interest rate, even though Eurozone inflation is still quite low. In light of his spectacular failure to anticipate the housing crisis, Fed Chairman Ben Bernanke is being careful not to offer unambiguous views on the impact of high oil prices. Thus, he has warned that it could translate into decreased GDP growth and higher prices for consumers, but he has stopped short of labeling it a serious threat.

On the one hand, the US economy is undergone some significant structural changes since the last energy crisis, which could mitigate the impact of sustained high prices. “The energy intensity of the U.S. economy — that is, the energy required to produce $1 of GDP — has fallen by 50% since then as manufacturing has moved overseas or become more efficient. Also, the price of natural gas today has stayed low; in the past, oil and gas moved in tandem. And finally, ‘we’re closer to alternative sources of energy for our transportation,’ ” summarized Wharton Finance Professor Jeremy Siegal. From this standpoint, it’s understandable that every $10 increase in the price of oil causes GDP to drop by only .25%.

On the other hand, we’re not talking about a $10 increase in the price of oil, but rather a $50 or even $100 spike. In addition, while industry is not sensitive to high commodity prices, American consumers certainly are. From automobile gasoline to home eating oil to agricultural staples (you know things are bad when thieves are targeting produce!), commodities still represent a big portion of consumer spending. Thus, each 1 cent increase in the price of gas sucks $1 Billion from the economy. “If gas prices increased to $4.50 per gallon for more than two months, it would ‘pose a serious strain on households and could put the entire recovery in jeopardy. Once you get above $5, [there is] probably above a 50% chance that the economy could face a downturn.’ ”

Even if stagflation can be avoided, some degree of inflation seems inevitable. In fact, US CPI is now 2.7%, the highest level in 18 months and rising. It is similarly 2.7% in the Eurozone and Australia, where both Central Banks have started to become more aggressive about tightening monetary policy. In the end, no country will be spared from inflation if commodity prices remain high; the only difference will be one of extent.

Over the near-term, much depends on what happens in the Middle East, since an abatement in political tensions would cause energy prices to ease. Over the medium-term, the focus will be on Central Banks, to see if/how they deal with rising inflation. Will they raise interest rates and withdraw liquidity, or will they wait to act for fear of inhibiting economic recovery? Over the long-term, the pivotal issue is whether economies (especially China) can become less energy intensive or more diversified in their energy consumption.

At the moment, most economies are dangerously exposed, with China and the US topping the list. Russia, Norway, Brazil and a select few others will earn a net benefit from a boom in prices, while most others (notably Australia and Canada) are somewhere in the middle.

No comments:

Post a Comment