What would you say if I told you that Amazon is lowering the price of the Kindle by $25? What if that meant you had to deal with ads? Bummer, right? What if I then told you that the ads wouldn’t appear while you were reading, just on the home page and screensavers? Okay, enough with the questions.

Amazon has announced that starting May 3rd, they will begin shipping their new “Kindle with Special Offers.” The new version of the popular e-reader will be $114, 18% less than the current cost of the original Kindle ($139).

The ‘”special offers” that readers see will apparently not interrupt reading at all. Amazon has listed some of the initial offerings that will be available to users when the product first rolls out:

The screensavers will be sponsored by Amazon partners Visa, Olay, Buick and Chase when the product launches, and they will look like this on your Kindle:

Users will be able to have some control over what type of screensavers they see, as Amazon is introducing “AdMash,” a free app that presents two screensaver options to readers and asks them to select the one that they like the most (or can tolerate the most, or despise the least). Those votes are tracked, and the most preferred sponsored screensavers are the ones that stick around.

On an options screen, users will also be able to select which type of screensavers they would like to see most, such as nature instead of architecture or modern images instead of country scenes.

In a statement on the amazon.com home page, CEO Jeff Bezos says that they are “working hard to makes sure that anyone who wants a Kindle can afford one.” $114 is a low price point for a Kindle, and the way they have structured the ads seems to be as minimal of an annoyance as possible. As someone who loves to read and has never bought the ads-free version of Words with Friends, this offer interests me. I am a little surprised the price wasn’t set lower, however. How often is someone able to afford $114 in discretionary spending but not $139?

However the sales shake out, this writer is thrilled whenever reading gets cheaper. Seriously, read books. Lots of ‘em.

Mitt Romney has announced the formation of an exploratory committee for a 2012 presidential bid via YouTube, and Twitter.

In the 2:30 video, the former governor of Massachesetts, talks about unemployment, foreclosures, and even gives Obama a ribbing over his policies. Romney also states, “He and the people around him have never worked in the real economy. They just don’t know how jobs are created in the private sector.”

How much social media play a role in the race to the White House? Let us know what you think.

@MittRomney

@MittRomney

Mitt RomneyI am announcing my Exploratory Committee for President of the United States. Join us at http://www.mittromney.com #Mitt2012 17 hours ago via web · powered by @socialditto

17 hours ago via web · powered by @socialditto

Romney’s video went live on Monday, just a week after we saw President Obama launch his 2012 reelection bid.

Even in its infancy, you can tell that the 2012 presidential race will be much more social media centric. During the 2008 campaign we saw Barack Obama essentially pioneer using Facebook and Twitter to reach the masses, while his competitor, John McCain, ran a more traditional campaign.

Do you think we’ve seen the last of the traditional political campaign? Leave your thoughts.

Imagine playing your favorite game on the iPhone, and upon making it to the final level and defeating the stage boss you’re offered a free cheeseburger at your favorite restaurant. Would such a system bring about positive or negative feelings from your gaming experience? Free stuff in the real world, based upon your performance in a mobile game. How are we just now coming up with this idea?

Kiip, an advertising network, plans to implement such a system. Their website tagline explains how it works – “Real rewards for virtual achievements“. Here’s a video going into a bit more detail about how Kiip works:

Kiip isn’t the first to offer real world rewards for playing a video game. However, their network has the potential to bring the idea of real world rewards for gameplay achievements to the mainstream.

If you’ve played free games on your mobile devices, chances are they are plagued with in-game advertising, which allows them to remain free. More often than not this really brings down a gaming experience, especially if the ads ruin your concentration. However, Kiip works like an achievement system so a pop-up wouldn’t occur until you actually complete a stage or objective.

According to Wired.com, the system simply requires a user to submit their email address to have their reward sent to them. Players aren’t required to sign up for a Kiip account, so the emails are only used to send them their branded reward. The network is based on HTML5 coding, so any system is compatible with the service. The only requirement is that it’s connected to the internet.

Though Kiip sounds interesting in theory, will it translate to success in real life? According to limited trials, players signed up for the achievement deals over 50 percent of the time. When’s the last time an advertising campaign saw those kinds of click-through rates?

At the head of Kiip is an internet prodigy, Brian Wong. If you’ve heard of Wong, it’s because at 18 years old he was able to land a job working for Digg. Upon leaving the company, he came up with the idea for Kiip.

To help keep a balance of how often rewards can be utilized, developers are provided a set amount of opportunities to utilize Kiip. Also, the system is set on a rotating variable so users aren’t going to be presented with a reward every time the same achievement is earned.

Upon reading about Kiip, I sent them a question in regards to how detailed developers could get in terms of which advertisers would be presented in their game. I presented a scenario where Coca-Cola released a game, and wouldn’t want a Pepsi reward popping up.

Here’s Wong’s response, “Users don’t choose what rewards they’ll see. The brands are able to set criteria for their target market. With verticals, through frequency capping, we’re able to guarantee that no competing products in the same space will appear in the same session.”

I think Kiip has a an interesting idea which could not only evolve in-game advertising, but mobile advertising as a whole. Imagine if such a system were utilized for check-in services as well, where surprise rewards would pop-up for checking in certain places.

The only roadblock keeping them back would be heavy saturation of their system on the market. There’s no set list of games where Kiip is being featured; they want their network to integrate naturally into the market. Coupled with their limiting algorithms and allowing developers a set amount of rewards to provide, they look to have all their ducks in a row.

So, you have all those followers on Twitter and yet when you tweet a link to your latest blog post…..nothing much happens!

Why did so few of those hundreds (or thousands) of your followers click your link; after all, it’s a great post?

People will ONLY click your links and read your content, if the headline or title is compelling enough. If just a small percentage of your followers are clicking on your links, it’s because the headline isn’t selling that link to your followers. It’s not compelling them enough, to make them want to click through to your site and find out more. Unless they do that, they will never know how great your posts are, which is why headlines are easily the most important element of your content.

Your headlines or titles are what open the door to your content. To succeed, your content has to be effective too, but nothing happens until people actually READ what you have written and your headline is what either encourages them to read the first line of your material – Or not. Get the headline wrong and you make it very hard for your content to get noticed.

To show you what I mean, I will use the example of yesterday’s post, which was extremely successful. It’s title was: Build a great client list with this 1 simple idea. Here are six of the secrets behind it.

The headline didn’t try and do everything. There was enough information in that headline to explain what the post was about and get the reader curious. To discover what the “1 simple idea” is, the reader has to click through. The more curious you can make someone, the more likely they are to take action; in this case click a link.

The headline was relevant to my readers. It was a marketing related headline and my friends on social networks connect with me because they are interested in marketing.

The headline made a compelling promise. Every headline makes a promise to the reader. The promise of that headline, is that if they click that link, I will give them some valuable information, which will help them with a huge problem; attracting better clients. The post content delivers on the promise, which is essential if you want people to come back! A great headline, which points to a post that fails to deliver on the headline’s promise, will cause people to feel cheated and stop them trusting your headlines and links in future.

The headline let people know it was easy. Part of the headline’s promise, is that they will learn this valuable information, quickly and easily. It’s just 1 simple idea. This requires little time investment from the reader, with the potential to learn some valuable business information.

The headline didn’t keyword stuff. Some people seem to believe that the only way to attract search engine traffic, is to stuff their headlines with keywords. This is flawed for 2 reasons.

The headline wasn’t clever. Some people write clever headlines, which lack any compelling reason for a busy person to click their link. They are often abstract or cryptic, rather than interest grabbing and inspiring.

There are very few things in life, which come with a guarantee, however, I can guarantee that if you make your blog post titles more compelling, you will definitely get more traffic from social networks and feedreaders.

Invest as much time as is required, to get your headlines as attractive as possible and just watch the increase in your blogging results.

Originally published on Jim’s Marketing Blog

Last week, Google announced that it was investing $5 million in a German solar power plant, and many people nodded in appreciation. Only it turns out the search giant was just warming up, as the company announced today it’s now putting almost $170 million into a solar plant much closer to home.

Rick Needham, Director of Green Business Operations at Google, wrote on the Official Google Blog, “We’ve invested $168 million in an exciting new solar energy power plant being developed by BrightSource Energy in the Mojave Desert in California. Brightsource’s Ivanpah Solar Electric Generating System (ISEGS) will generate 392 gross MW of clean, solar energy. That’s the equivalent of taking more than 90,000 cars off the road over the lifetime of the plant, projected to be more than 25 years.”

Then, while noting that this does represent Google’s largest clean tech investment (“to date”), Needham continued, “The investment makes business sense . . .”

That should come as a relief to investors who are concerned about how Google will perform under Larry Page. And that’s starting to be a serious factor, too, since the company’s stock has dropped 2.43 percent since Page took over as CEO a week ago. (For reference: the Nasdaq’s lost just 0.65 percent and the Dow is up a tiny bit over the same period.)

Anyway, the “Ivanpah Power Tower,” as the solar project’s known, is supposed to be finished in 2013. NRG is an additional supporter, and the U.S. Department of Energy is providing clean energy technology loan guarantees.

The introduction of Forex trading tools have made this business more simple and easy to understand for newbie’s. Actually, none of the device can be considered as ideal for the sake of currency trading. Nonetheless, the professional in this field have developed couple of practical instruments that offer a comprehensive idea about the currency market.

The more skilled traders in this professional have accepted the fact that right t use of Forex trading tools will bring substantial earnings.

The Forex trading entails the swapping of international currencies and also earning money through this practice. The market of Forex trading has been scattered on geographical basis and is illustrated by large investments. The Forex trading tools facilitate the trader in getting the latest information about the market trends; hence he/she can earn more profits.

The most vital characteristics of Forex trading tools are to supply the reviews of main currencies on daily basis. These also provide weekly reviews of the currencies besides the other main updated information about the market. This aids the traders in understanding the most recent situation of the currency market through which they evaluate the market stipulation. By having a thorough knowledge about the currency market, the traders can forecast the potential tendencies and invest accordingly.

In this regard couple of mechanical softwares has been launched as Forex trading tools. The development in technology has invented certain softwares that gather all the essential details robotically and save this information for the trader.

Currently the task of evaluating the currency has become very simple. In this regard, the novice traders particularly use these gears in practical and useful manner. These software tools can be downloaded from internet for an insignificant cost. Now you can access the latest market situation just with few mouse clicks.

Numerous currencies are traded on daily basis in Forex trading market. It is therefore, not an easy job to maintain the record of whole trade with the alteration in rates of different currencies.

As a vigilant trader, one must be aware of the most recent happening in the currency market. This purpose can solely be achieved with the help of Forex trading tools. It provides an immediate access to the trading reviews; else it would not be easy to acquire these reviews.

If the trader has information about the prevailing rates as well as the daily and weekly reviews, he/she can take more appropriate decision. There are couple of more tools that assist trader to keep an eye on rates of interest.

These tools also provide them complete accessibility to the dictionary as well as the monetary almanac. All these gadgets are mandatory for Forex trading.

Now these Forex trading tools are within the reach of traders in their own homes. The biggest benefit of Forex trading is flexibility of time, because the currency market is open 24 hours a day. The trading activities can be performed with the help of internet and the cash can also be relocated automatically with the help of electronic machines

If you have PC as well as the internet at your place, you will have an easy access to the Forex tools and the foreign currencies for trading. There are plentiful companies on internet that offer the functional gadgets, such as comprehensive market study for easy trading.

These online tools can be downloaded from internet free of cost. If a trader would like to save cash, he/she can utilize these online tools. These online companies issue financial reports and also have various discussion forums

The existing Forex graphs as well as the other covert trading information unearthed by the internet companies are also very helpful for the investors. The combinations of one’s skills with the Forex trading tools will surely make him/her triumphant.

Demat account, short for dematerialized account, is an account needed for keeping securities in a dematerialized form. In India, a demat account is mandatorily required to be able to invest and trade in the Indian Share Exchanges. Possession of demat account has been produced compulsory by SEBI, an abbreviation for the Securities and Exchange Board of India, which is the authoritative and regulatory body for the country’s share exchanges.

As specified by the SEBI, the demat account is to be opened with a Depository Participant (DP). All of the banks and brokers offering depository services are known as DP. However, the contrary is doesn’t hold true.

You’ll find particular charges levied on the customer by a Depository Participant (DP), which holds demat account for its customers, for possessing a demat account. You can find four first charges levied on the customer, namely demat account opening fee, annual maintenance charges, brokerage or transaction fee, and custodian fee. In addition to these four, a DP also levies a charge for the conversion of shares from its physical form to the electronic form, or from electronic to physical form. This fee is different for both remat and demat instructions. For dematerialization of securities, many of the DPs levy a fixed charge on each such request along with a fee that varies dependant on the amount of certificates needed. The fees levied by other DPs are fully variable.

Nevertheless, no fee is chargeable on a BO (Beneficiary Owner) by a DP if the BO moves all of the securities held in his demat account to a similar DP’s numerous other branch or to the the other DP of another or same depository. On the contrary, this is applicable only once the BO Account(s) at transferor DP and at transferee DP is same in every single respect. If the BO Account at the transferor DP happens to be a joint account, then the BO Account at transferee DP also should be a joint account, with the identical ownership sequence.

The DPs are allowed to revise their charges. Nevertheless for that, the DP has to give a notice of 30 days in advance. Other than that, DPs also charge service duty for their customers. Hence, it is always suggested to maintain all your accounts with a single depository participant. This helps in generating the tracking of funds gains liability easier. It’s because; the determination of keeping period varies from DP to DP, hence, affecting the calculation of capital profits tax.

You can find more information about hot penny stocks to watch , canadian stock brokers , and daily stock picks

Mail this post

Mail this postTechnical analysis is the prediction method that is used in forex trading to forecast price action in forex market. This analysis works only on the data generated by the market. Almost every forex trader takes help from some type of technical analysis method to predict the forex market trend.

Price charts are on of these analysis methods. By the help of price charts, traders can find out the perfect entry and exit points for any trading process. These charts provide a visual representation of the previous price movements. This feature makes it easier for traders to find out the upcoming price changes, as just by reviewing these charts traders can determines whether they are selling at a cyclical top or purchasing at a fair price.

A perfect technical analysis method also takes the fundamental pointers into consideration and it works with these pointers by joining them with the data tables and charts. The assumption that is used in technical analysis is that it incorporates all the basic fundamentals into the actual market data.

There are certain principles that are working behind all the technical analysis methods. Basically, there are three main principles and these principles are actually the market actions that are taken in accordance with the latest events, historical forex trends, and price action trends.

Basically, technical analysis methods are highly dependent on the mathematical calculations that are done for the forex market behaviors and patterns. These representations are mainly the volume charts, price charts and a huge list of various particular analysis methods.

The data that is generated by the market is used to identify the sustainability and intensity of a specific trend. Therefore, technical analysis is the method that enables you to create an efficient trading plan.

A variety of chart patterns is included in few of the basic pie charts that determine the price movements. The commonest charts include the bar charts.

Each bar chart describes one time period that could consist of any duration i.e. from one minute to several years.

Forex charting techniques or candlestick patterns are used to predict the trends of forex market. Candlesticks patterns provide eye candy visual details within the bar graphs and other chart patterns with its colored bodies.

Usually the figure and point patterns are similar to that of the bar chart; however, the Os and Xs are utilized for the changes in market in the price actions.

Technical Pointers – These pointers such as market volatility, strength, cycle, trend, resistance or support, momentum pointers are also the important and inevitable tools in technical analysis. Trends determine the constancy of price actions in a single direction over a particular period of time. Trends move in three distinct directions i.e. up, down and sideways.

Market Intensity – It is the strength of forex market opinion in accordance with the price by the market positions examination carried out by different participants of the market. They are basically consisted of the open interest or volume.

Market Volatility – It is the magnitude of forex market or the size of the every day price fluctuations independent of the direction of price. Changes in the market volatility lead to the price changes.

Cycle – It basically points out the repetition pattern of the movement of market in accordance with the recurrent events like yearly budget, elections, or seasons. Cycle pointers actually identify the timings of specific patterns of market.

Resistance or Support – It describes the levels of price within which the markets repeatedly changes i.e. rise or drop and reverse.

Momentum – It is the speed of price movements within a given period of time. The momentum pointers identify the weakness or strength of any particular trend. Usually, at the beginning of a trend momentum is at its highest point, while it reaches its lowest point at the turning points of the trend.

In order to utilize technical analysis in an effective manner, you have to understand the basic points of technical analysis. You should bear in mind that your primary tool is price. Apart from that, almost all systems use the technical methods to dig the data deeper. You should be aware of how and why all technical studies can be connected together to produce effective results.

Propelled by economic recovery and the recent Mideast political turmoil, oil prices have firmly shaken off any lingering credit crisis weakness, and are headed towards a record high. Moreover, analysts are warning that due to certain fundamental changes to the global economy, prices will almost certainly remain high for the foreseeable future. The same goes for commodities. Whether directly or indirectly, the implications for forex market will be significant.

First of all, there is a direct impact on trade, and hence on the demand for particular currencies. Norway, Russia, Saudia Arabia, and a dozen other countries are witnessing record capital inflow expanding current account surpluses. If not for the fact that many of these countries peg their currencies to the Dollar and/or seem to suffer from myriad other issues, there currencies would almost surely appreciate. In fact, the Russian Rouble and Norwegian Krona have both begun to rise in recent months. On the other hand, Canada and Australia (and to a lesser extent, New Zealand) are experiencing rising trade deficits, which shows that their is not an automatic relationship between rising commodity prices and commodity currency strength.

Those countries that are net energy importers could experience some weakness in their currencies, as trade balances move against them. In fact, China just recorded its first quarterly trade deficit in seven years. Instead of viewing this in terms of a shift in economic structure, economists need to understand that this is due in no small part to rising raw materials prices. Either way, the People’s Bank of China (PBOC) will probably tighten control over the appreciation of the Chinese Yuan. Meanwhile, the nuclear crisis in Japan is almost certainly going to decrease interest in nuclear power, especially in the short-term. This will cause oil and natural gas prices to rise even further, and magnify the impact on global trade imbalances.

A bigger issue is whether rising commodities prices will spur inflation. With the notable exception of the Fed, all of the world’s Central Banks have now voiced concerns over energy prices. The European Central Bank (ECB), has gone so far as to preemptively raise its benchmark interest rate, even though Eurozone inflation is still quite low. In light of his spectacular failure to anticipate the housing crisis, Fed Chairman Ben Bernanke is being careful not to offer unambiguous views on the impact of high oil prices. Thus, he has warned that it could translate into decreased GDP growth and higher prices for consumers, but he has stopped short of labeling it a serious threat.

On the one hand, the US economy is undergone some significant structural changes since the last energy crisis, which could mitigate the impact of sustained high prices. “The energy intensity of the U.S. economy — that is, the energy required to produce $1 of GDP — has fallen by 50% since then as manufacturing has moved overseas or become more efficient. Also, the price of natural gas today has stayed low; in the past, oil and gas moved in tandem. And finally, ‘we’re closer to alternative sources of energy for our transportation,’ ” summarized Wharton Finance Professor Jeremy Siegal. From this standpoint, it’s understandable that every $10 increase in the price of oil causes GDP to drop by only .25%.

On the other hand, we’re not talking about a $10 increase in the price of oil, but rather a $50 or even $100 spike. In addition, while industry is not sensitive to high commodity prices, American consumers certainly are. From automobile gasoline to home eating oil to agricultural staples (you know things are bad when thieves are targeting produce!), commodities still represent a big portion of consumer spending. Thus, each 1 cent increase in the price of gas sucks $1 Billion from the economy. “If gas prices increased to $4.50 per gallon for more than two months, it would ‘pose a serious strain on households and could put the entire recovery in jeopardy. Once you get above $5, [there is] probably above a 50% chance that the economy could face a downturn.’ ”

Even if stagflation can be avoided, some degree of inflation seems inevitable. In fact, US CPI is now 2.7%, the highest level in 18 months and rising. It is similarly 2.7% in the Eurozone and Australia, where both Central Banks have started to become more aggressive about tightening monetary policy. In the end, no country will be spared from inflation if commodity prices remain high; the only difference will be one of extent.

Over the near-term, much depends on what happens in the Middle East, since an abatement in political tensions would cause energy prices to ease. Over the medium-term, the focus will be on Central Banks, to see if/how they deal with rising inflation. Will they raise interest rates and withdraw liquidity, or will they wait to act for fear of inhibiting economic recovery? Over the long-term, the pivotal issue is whether economies (especially China) can become less energy intensive or more diversified in their energy consumption.

At the moment, most economies are dangerously exposed, with China and the US topping the list. Russia, Norway, Brazil and a select few others will earn a net benefit from a boom in prices, while most others (notably Australia and Canada) are somewhere in the middle.

Foreign exchange can prove to be very profitable if you trade wisely. Listed below are a few perks of forex trading:

Learning the art of managing the risks plays a vital role in forex trading. A considerably high level of reluctance is often observed among individuals when it comes to forex trading. However, regardless of its nature, trade and risk go side by side, hence the need for risk management.

To prevent any avertable risks, it is highly advisable to avoid scam dealers. Everything should be kept legal and transparent with the forex agent regarding the investment proposals and procedures. As mentioned earlier, forex trading comes with a handful of risks. Say, for instance, you are offered a leverage of 250:1 by a forex broker. In such a situation, you need to be fully aware of when the broker is actually making you profitable and when he is not being facilitative to your trade.

Forex agents might often show perseverance over higher leverage values, as it suits their interest. However, for you, although high leverage might prove to be profitable, but there is an equal risk of loss as well. Therefore, vigilance and risk management can rid you of such trading.

Being in control of your risk, since right the beginning, puts you in a better place, where you can use the leverage sensibly to make the best out of the investment. Therefore, while choosing a forex agent, you should only commit the amount that is needed for the trade, or what you can afford to lose. However, it requires adequate risk management.

The foreign exchange market is unpredictable. Forex rates may fluctuate during the moment you place the deal and when you go for liquidating it. This will have a toll on the forex price contract and eventually the prospective profit or loss pertaining to it.

You should arrange your risk management profile in such a way that it limits the forex agent from taking risks which you cannot afford. This way you can prevent the risk of losing the capital of your investment.

Risk management in the forex market involves another method, known as diversification. More entry signals can be generated by trading one currency pair. Diversification of trade between different currencies is advisable, if you intend to lower the risk in the forex market. You should try trading several pairs of currency at the same time.

Trading with a bit too high margin should be avoided. Forex trading is not different than any other form of trade. Therefore, it is strictly advised to observe, practice, learn, and polish your skills before you put them to test. Resources like e-books, papers, the internet, video courses, and seminars should be relied on. You should test your skills on the demo account that is provided for free.

When you’re in the forex market, the key to risk management is knowledge. Self education is the best thing you can do before stepping into trade. How chart indicators are to be read? How the analysis data is to be read? What is the driving force of the currency price movement? Operational and counter-party risks are minimized by instantaneous settlements.

Over the last year and increasingly over the last few months, Central Banks around the world have taken center stage in currency markets. First, came the ignition of the currency war and the consequent volley of forex interventions. Then came the prospect of monetary tightening and the unwinding of quantitative easing measures. As if that wasn’t enough to keep them busy, Central Banks have been forced to assume more prominent roles in regulating financial markets and drafting economic policy. With so much to do, perhaps it’s no wonder that Jean-Claude Trichet, head of the ECB, will leave his post at the end of this year!

The currency wars may have subsided, but they haven’t ended. On both a paired and trade-weighted basis, the Dollar is declining rapidly. As a result, emerging market Central Banks are still doing everything they can to protect their respective currencies from rapid appreciation. As I’ve written in earlier posts, most Latin American and Asian Central Banks have already announced targeted strategies, and many intervene in forex markets on a daily basis. If the Japanese Yen continues to appreciate, you can bet the Bank of Japan (perhaps aided by the G7) will quickly jump back in.

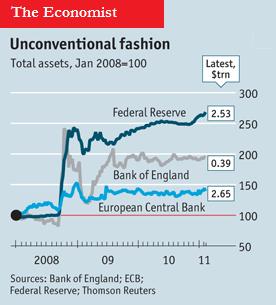

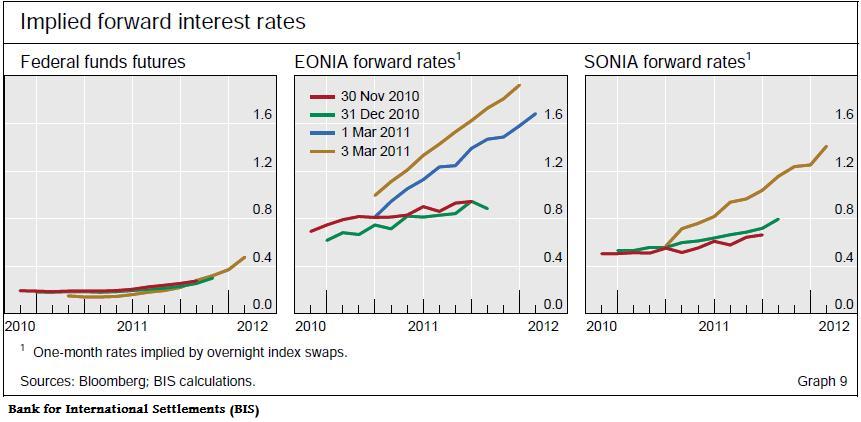

You can expect the currency wars to continue until the quantitative easing programs instituted by the G4 are withdrawn. The Fed’s $600 Billion Treasury bond buying program officially ends in June, at which point its balance sheet will near $3 Trillion. The European Central Bank has injected an equally large hunk of cash into the Eurozone economy. Despite inflation that may soon exceed 5%, the Bank of England voted not to sell its cache of QE assets, while the Bank of Japan is actually ratcheting up its program as a result of the earthquake-induced catastrophe. Whether or not this manifests itself in higher inflation, investors have signaled their distaste by bidding up the price of gold to a new record high.

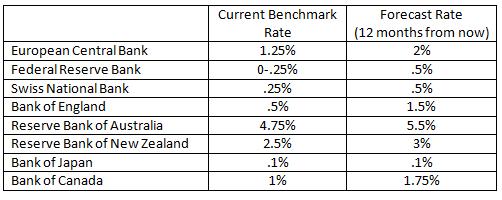

Then there are the prospective rate hikes, cascading across the world. Last week, the European Central Bank became the first in the G4 to hike rates (though market rates have hardly budged). The Reserve Bank of Australia, however, was the first of the majors to hike rates. Since October 2009, it has raised its benchmark by 175 basis points; its 4.75% cash rate is easily the highest in the industrialized world. The Bank of Canada started hiking in June 2010, but has kept its benchmark on hold at 1% since September. The Reserve Bank of New Zealand lowered its benchmark to a record low 2.5% as a result of serious earthquakes and economic weakness.

Going forward, expectations are for all Central Banks to continue (or begin) hiking rates at a gradual pace over the next couple years. If forecasts prove to be accurate, the US Federal Funds Rate will stand around .5% at the beginning of 2012, tied with Switzerland, and ahead of only Japan. The UK Rate will stand slightly above 1%, while the Eurozone and Canadian benchmarks will be closer to 2%. The RBA cash rate should exceed 5%. Rates in emerging markets will probably be even higher, as all four BRIC countries (Russia, Brazil, China, India) should be well into the tightening cycles.

On the one hand, there is reason to believe that the pace of rate hikes will be slower than expected. Economic growth remains tepid across the industrialized world, and Central Banks are wary about spooking their economies with premature rate hikes. Besides, Fed watchers may have learned a lesson as a result of a brief bout of over-excitement in 2010 that ultimately led to nothing. The Economist has reported that, “Markets habitually assign too much weight to the hawks, however. The real power at the Fed rests with its leaders…At present they are sanguine about inflation and worried about unemployment, which means a rate rise this year is unlikely.” Even the ECB disappointed traders by (deliberately) adopting a soft stance in the press release that accompanied its recent rate hike.

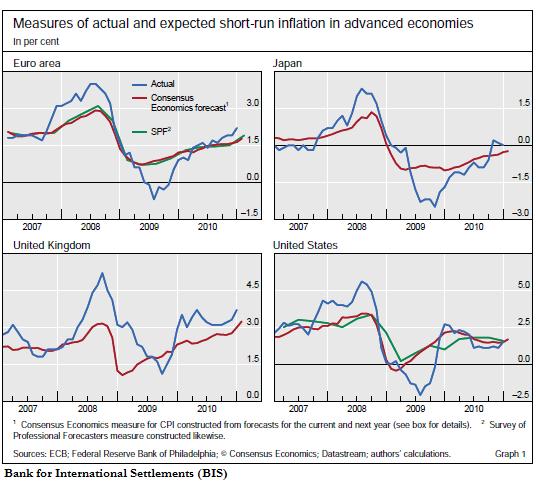

On the other hand, a recent paper published by the Bank for International Settlements (BIS) showed that the markets’ track record of forecasting inflation is weak. As you can see from the chart below, they tend to reflect the general trend in inflation, but underestimate when the direction changes suddenly. (This is perhaps similar to the “fat-tail” problem, whereby extreme aberrations in asset price returns are poorly accounted for in financial models). If you apply this to the current economic environment, it suggests that inflation will probably be much higher-than-expected, and Central Banks will be forced to compensate by hiking rates a faster pace. Finally, in their newfound roles as economic policymakers, Central Banks are increasingly engaged in macroprudential policy. The Economist reports that, “Central banks and regulators in emerging economies have already imposed a host of measures to cool property prices and capital inflows.” These measures are worth watching because their chief aim is to indirectly reduce inflation. If they are successful, it will limit the need for interest rate hikes and reduce upward pressure on their currencies.

Finally, in their newfound roles as economic policymakers, Central Banks are increasingly engaged in macroprudential policy. The Economist reports that, “Central banks and regulators in emerging economies have already imposed a host of measures to cool property prices and capital inflows.” These measures are worth watching because their chief aim is to indirectly reduce inflation. If they are successful, it will limit the need for interest rate hikes and reduce upward pressure on their currencies.

In short, given the enhanced ability of Central Banks to dictate exchange rates, traders with long-term outlooks may need to adjust their strategies accordingly. That means not only knowing who is expected to raise interest rates – as well as when and by how much – but also monitoring the use of their other tools, such as balance sheet expansion, efforts to cool asset price bubbles, and deliberate manipulation of exchange rates.

Over the last three months, the Euro has appreciated 10% against the Dollar and by smaller margins against a handful of other currencies. Over the last twelve months, that figure is closer to 20%. That’s in spite of anemic Eurozone GDP growth, serious fiscal issues, the increasing likelihood of one or more sovereign debt defaults, and a current account deficit to boot. In short, I think it might be time to short the Euro.

There’s very little mystery as to why the Euro is appreciating. In two words: interest rates. Last week, the European Central Bank (ECB) became the first G4 Central Bank to hike its benchmark interest rate. Moreover, it’s expected to raise rates by an additional 100 basis points over the next twelve months. Given that the Bank of England, Bank of Japan, and US Federal Reserve Bank have yet to unwind their respective quantitative easing programs, it’s no wonder that futures markets have priced in a healthy interest rate advantage into the Euro well into 2012.

From where I’m sitting, the ECB rate hike was fundamentally illogical, and perhaps even counterproductive. Granted, the ECB was created to ensure price stability, and its mandate is less nuanced than its counterparts, which are charged also with facilitating employment and GDP growth. Even from this perspective, however, it looks like the ECB jumped the gun. Inflation in the EU is a moderate 2.7%, which is among the lowest in the world. Other Central Banks have taken note of rising inflation, but only the ECB feels compelled enough to preemptively address it. In addition, GDP growth is a paltry .3% across the EU, and is in fact negative in Greece, Ireland, and Portugal. As if the rate hike wasn’t bad enough, all three countries must contend with a hike in their already stratospheric borrowing costs, ironically making default more likely. Talk about not seeing the forest for the trees!

If the rumors are true, Portugal will soon become the third country to receive a bailout from the EU. (It should be noted that as recently as November, Portugal insisted that it was just fine and that a bailout wasn’t necessary). Its sovereign credit rating is now three notches above junk status. Today, Greece became the first Eurozone country to be awarded this dubious distinction, and Ireland is now only one downgrade away from suffering the same fate. Of course, Spain insists that it is just fine and denies the possibility of a bailout. At this point, though, does it have any credibility? Based on rising credit default swap rates (which serve as a gauge of the probability of default), I think that investors have become a little more cynical about taking governments at face value.

I have discussed the fiscal woes of the Eurozone in previous posts, and don’t want to dwell on them here. For now, I’d only like to add a footnote on the extent to which their problems are intertwined. Banks in Germany and France (as well as the rest of the EU) have tremendous balance sheet exposure to PIGS’ sovereign debt, which means that any default would multiply across the Eurozone in the form of bank failures. (You can see from the chart below that the exposure of the US is small, relative to GDP).

Some analysts insist that all of this has already been priced into the Euro. Citigroup Said, “The market is treating many of these [sovereign credit rating] downgrades as rearguard actions which are already well discounted.” Personally, I don’t think that forex markets have made a sincere effort to grapple with the possibility of default, which appears increasingly inevitable. In fact, when S&P issued a warning on the US AAA rating, traders responded by handing the Euro its worst intraday decline in 2011.

Any way you cut it, I think the Euro is overvalued. Regardless of what the ECB is doing, market interest rates don’t really confer much benefit to those holding Euros. Even if the rate differential widens to 1-2% over the next year (which is certainly not guaranteed, as Jean-Claude Trichet himself has conceded!) this isn’t really enough to compensate for the possibility of default or other risk event. Regardless of whether you want to be long or short risk, there isn’t much to be gained at the moment from holding the Euro.